Grow your lending business with less risk and effort

Your shortcut to smarter lending

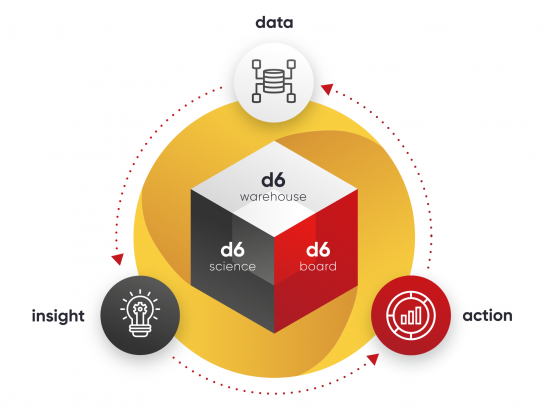

Every day hundreds of decisions influence your profitability and risk. Who could borrow more? What amount should we offer? Will this customer repay on time? d6 is a complete cloud-based AI solution that enables operational teams to strengthen their own judgement with forecasts and recommendations. The platform equips you with the three core capabilities to transform data into actions that impact your business.

d6 warehouse

The fundamental component that brings your data together in a central repository and ensures data quality.

d6 science

A collection of algorithms and behavioural analysis models providing customer insights.

d6 board

The user interface with personalised dashboards for 360 views on all types of loan portfolios.

Predictions are most valuable when they lead to action

Core banking systems capture a lot of data every day that reveal customer profiles: credit and debit transactions, disbursements, account and loan balances, instalments, savings, partial payments, arrears. Our behavioural models look at past behaviour to forecast future behaviours. No matter where you are on your journey of becoming an intelligent, data-driven financial services provider, d6 boosts your capacity to use your data to its full potential.

Why

leading lenders

love d6

01

Save time with proven models

Our data structure and algorithms are the result of years of experience with banks who lend to small businesses, particularly in emerging markets.

02

Deploy solutions within weeks

Cloud native technologies ensure optimal security and scalability. Integrated with major core banking systems, d6 can start delivering value in no time.

03

Make decisions with confidence

Our AI models are transparent so your staff can understand the rationale behind the recommendations. The system provides suggestions, you control the final decision.

04

Realise your vision with our bespoke approach

One size doesn’t fit all, which is why our customer success managers make sure that our solutions respond to your needs.

05

Deliver fair and inclusive services

Traditional scorecards compromise customer satisfaction because of selection bias and the lack of a customer’s control over their score. Our approach focuses on inclusion and fairness to encourage desired repayment habits from your customers.

Use Cases

BAOBAB

Automated loan renewal

We helped Baobab fully automate up to 40% of loan renewals. The solution proved highly replicable and was swiftly implemented in 8 countries in less than 6 months, leading to client retention and increased staff efficiency and a strong differentiation on highly competitive markets.

ADVANS CAMEROUN

Nano loan product

Advans Cameroun came to us to launch a short-term nano loan with a flexible repayment scheduled. By leveraging customer data to automate loan decisions and providing the right incentives for customers to repay early, Advans created new growth opportunities within existing customer portfolios.

GROOMING CENTRE

Data warehouse as a service

We set up a central cloud-based data warehouse for Grooming Centre to store data from all business lines and distribution channels. Reporting and performance monitoring tools are updated daily, improving transparency and allowing managers to make better-informed decisions.