Our winning lending tech stack

Our modular platform provides everything you need to accelerate loan product innovation and lend at scale.

Truly modern

Cloud-based, API-driven, single codebase and multi-tenant for reliable, future-proof services.

User friendly

Intuitive dashboards for your front-line staff and well-documented APIs for your developers.

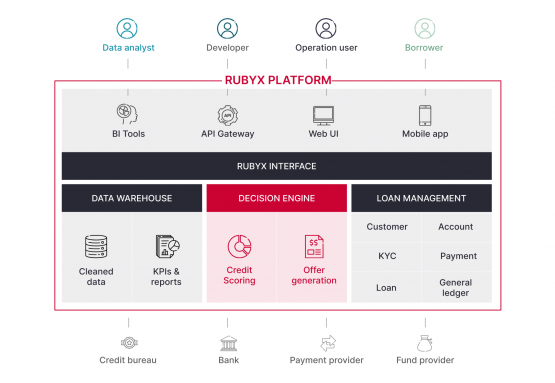

RUBYX PLATFORM

4 complementary solutions for end-to-end lending ops

- Data Warehouse - Get your data in shape for efficient analysis.

- Decision Engine - Improve credit risk analysis with AI algorithms.

- Loan Management System - Complete services for non-lenders.

- Rubyx Interface - Convenient access for various types of users.

DATA WAREHOUSE

Analyze your data efficiently without burdening your operational systems

Exportable Data Sets

Our predefined data model allows us to get your warehouse up and running in no time.

Automated data correction and enrichment

Our corrections improve the quality of data coming from various sources. Enrich it with key performance indicators and risk metrics.

Accurate reporting and alerts

Well-structured data allows for reliable reporting and makes it easy to respond to demands of different departments.

Cloud-based ecosystem

Import data into BI solutions such as Google Data Studio, Qlik, PowerBI, Tableau or Custom SQL Queries.

Comprehensive risk analysis

Our behavorial analysis framework makes it possible to define risk profiles in heterogeneous data contexts such as microfinance, e-commerce, payment provider, or telco, and for various applications including first loan, renewal, and debt collection.

Customer prequalification

Our risk approach is designed to generate pre-approved credit offers daily for each customer. The optimal amounts are defined by maximizing the profit by accounting for the probability of intake and default of each offer.

Tailored scoring strategies

Each scoring strategy is unique and can be customized to take into account the specifics of each institution. Different scoring strategies can also be deployed in parallel on different customer segments or for A/B testing.

Continuous risk monitoring

Risk exposure is continuously monitored in order to adapt credit disbursements to repayment performance. This is also used for legal reporting to the relevant financial partners.

DECISION ENGINE

Data Intelligence to streamline financial operations

LOAN MANAGEMENT SYSTEM

A complete system for non-lenders

GDPR-compliant customer management

Rubyx manages KYC stages and levels, verifies the authenticity and validity of ID documents, and validates identities against sanction lists. In particular, ensuring that one real person cannot use multiple digital profiles to borrow and bypass the limits.

Loan bookkeeping

Lending services require a dedicated loan management system for back office and bookkeeping, ensuring that all disbursed loans are properly created, managed and recorded on the bank’s books.

Payments

Borrowers can receive funds and repay their loans using electronic money transfers from a bank or mobile money account. This is a crucial feature of offering a lean customer experience where the digital loan offer integrates seamlessly with the existing financial services used by the borrowers. Rubyx pre-integrates with third-party payment gateway providers offering APIs for your development team to integrate with your existing payment system.

Web UI

A responsive Web Application provides the staff with an overview of portfolios on different levels of your organization. A Series of dashboards allows the operational team to monitor the risk and performance of your customers and loans.

Mobile application

A white-labeled mobile app gives your borrowers a complete view of their loans and credit scoring. Borrowers can perform disbursement and repayment anytime with a few clicks on their smartphone.

API Gateway

Enhance your digital platform with our Lending-as-a-Service platform. We offer APIs to integrate your existing systems seamlessly for technical teams.

BI tools

We offer BI tools for your data analysts to unleash the full potential of the Rubyx data warehouse. Or you can choose your own tools that you feel most comfortable with.

RUBYX INTERFACE

The power of data in the hands of your staff

EXAMPLES OF TECHNOLOGY WE RELY ON